New Listings: December saw a decrease in new listings, with 1026 new listings compared to 1073 in December 2022, marking a 4.4% drop. This decrease was even more pronounced from November 2023, with a 43.9% decrease from 1828 listings. While this decline might seem significant, it aligns with typical seasonal trends where listing activity often slows down during the winter months.

Pending Sales: Pending sales showed a mixed trend. There was an 8.5% increase from December 2022 which could show growing momentum for the coming year.

Closed Sales: The number of closed sales in December saw a decrease of 9.2% from December 2022’s due to slow pending sales in November

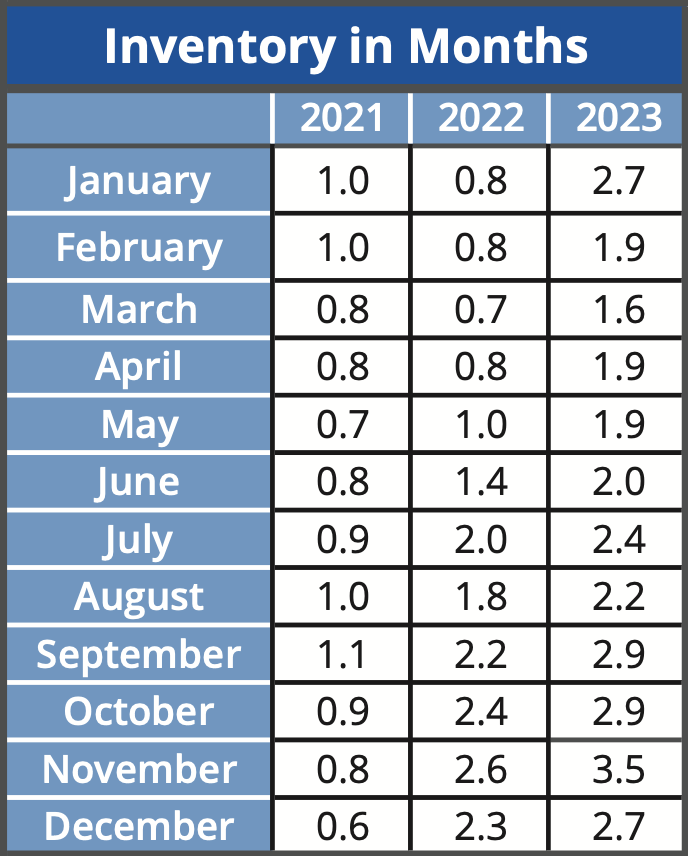

Inventory and Market Time: Inventory levels decreased to 2.7 months, indicating a tighter market. The total market time increased to 60 days, suggesting a slight slowdown in the pace at which properties are selling.

Yearly Comparison: Comparing the entire year of 2023 with 2022, there was an 18.0% decrease in new listings, a 20.4% decrease in pending sales, and a 25.2% decrease in closed sales. In terms of pricing, the average sale price dropped by 2.1% from $610,900 to $598,000, while the median sale price decreased by 3.0% from $548,400 to $532,000.

These statistics reflect a market that, while adjusting to broader economic factors, still feels resiliant. The decrease in new listings is a seasonal effect rather than a sign of market weakness. Inventory constraints continue to be a factor, influencing both pricing and the speed of sales. We’re expecting things to quickly pick-up by early Feb as buyers feel optimistic about recent interest rate drops helping them with affordability.